Are you struggling to get fair compensation for your hurricane damage claim in Louisiana?

You’ve paid your insurance premiums, but now your insurer is delaying, undervaluing, or even denying your claim. Dealing with these tactics while trying to rebuild your home can be maddening. A Louisiana hurricane damage lawyer from Insurance Claim HQ can help you fight for the full compensation you deserve.

Why choose us?

We have 25-plus years of experience in Louisiana insurance law and know the tactics insurers use to get around paying out policyholders’ claims. Our lawyers have recovered more than $1 billion for 70,000-plus clients in Louisiana, the Deep South, and across the U.S.

The insurance carriers know we mean business.

However, our reputation for excellence in property casualty matters extends beyond the settlement table and the courtroom. What sets us apart is knowing firsthand what’s involved with rebuilding and recovery following a hurricane. Several of our lawyers are from or live in Louisiana and the Deep South.

We’ve witnessed and experienced what a hurricane can do to people’s homes, communities, and lives. Our neighbors’ physical and emotional strain is real, so we fight for them.

Don’t let the insurance company shortchange your claim. Contact ICHQ today for a free consultation, and let us help you take the next step toward securing the funds you need to recover from a hurricane.

How a Louisiana Hurricane Damage Insurance Claim Lawyer Can Help with Your Case

Filing a hurricane damage insurance claim in Louisiana can be frustrating.

Insurance companies often use tactics like delaying responses, requiring excessive documentation, or claiming that certain types of damage aren’t covered to minimize what they pay out. Some also try to undervalue claims by using low estimates for repair costs or arguing that pre-existing damage caused the issues.

This approach can leave property owners with settlements that fall far short of what they need to repair their homes.

We at ICHQ can help you push back against underhanded insurance tactics. Our lawyers understand hurricane claims and Louisiana insurance laws, so we can advocate for your rights and seek the compensation you need for recovery.

We can review your policy in detail, gather and present evidence of your losses, and negotiate directly with the insurance company to demand a fair settlement. If necessary, we can also represent you in court to fight for the insurance money you need.

Our hurricane lawyers can handle claims involving all types of hurricane damage, including the following:

- Roof shingles

- Gutters

- Siding

- Windows

- Doors

- Garage doors

- Exterior paint

- Foundations

- Exterior walls

- Interior walls

- Ceilings

- Flooring

- Electrical wiring

- HVAC systems

- Plumbing

- Water heaters

- Insulation

- Kitchen appliances

- Basements

- Septic systems

What Does a Hurricane Insurance Policy Typically Cover?

Hurricane insurance policies usually cover damage that strong winds, flying debris, and rain cause during a hurricane. This includes harm to roofs, windows, siding, and other structural elements. For most policies, coverage also extends to interior damage if wind forces rainwater or debris into a home.

Many policies will also cover damage to attached structures like garages and sometimes detached structures like sheds.

Additionally, some hurricane policies help with temporary living expenses if hurricane damage makes a property unlivable while repairs are underway. Personal property, such as furniture, electronics, and appliances, are also covered by some policies.

However, insurance limits vary widely, and coverage amounts and exclusions depend on the terms of each policy.

What Are the Possible Exceptions on a Hurricane Insurance Policy?

Hurricane insurance policies often include exceptions, which means they won’t cover certain types of damage or situations.

One common exception is flood damage, which often requires a separate flood insurance policy. Many policies also have specific deductibles for hurricane damage, which could be higher than those for other types of claims.

Some policies exclude coverage for damage resulting from neglect, such as issues that arise if a property is not well-maintained before a storm.

Additionally, some policies might exclude certain items or parts of the home, like fences, landscaping, or outdoor pools. In other cases, policies won’t cover wind-driven rain damage if it enters through windows or doors left open during a hurricane.

Does Hurricane Insurance Cover Flood Damage?

It depends. Most hurricane insurance policies do not cover flood damage.

This means coverage for damage from rising waters — whether from storm surges, rivers, or lakes overflowing — usually requires a separate flood insurance policy. While hurricane insurance might cover wind-driven rain that enters through storm damage, it typically won’t apply to water damage that comes from the ground up.

For flood damage, homeowners must usually have a policy through the National Flood Insurance Program (NFIP) or a private flood insurer.

Property owners in hurricane-prone areas like Louisiana often need both hurricane and flood insurance to cover the full range of storm-related damage. Without flood insurance, property owners could face costly out-of-pocket repairs if flooding occurs during a hurricane.

How Could Insurance Companies Act in Bad Faith in My Hurricane Damage Claim?

Bad faith insurance practices occur when an insurance company fails to honor its obligations under a policy or does not treat a policyholder fairly.

Common bad faith practices in hurricane damage claims include denying valid claims without proper investigation, delaying responses without reason, or offering unreasonably low settlements.

Insurers might also act in bad faith by ignoring information a policyholder provides or demanding excessive documentation just to make the process difficult.

If your hurricane claim is denied, undervalued, or delayed because of your insurance company’s bad faith tactics, you could have the right to take legal action. A knowledgeable Louisiana hurricane damage attorney from ICHQ can help you file a bad faith insurance claim to hold your insurer accountable and secure the compensation you deserve for your property repairs.

What Legal Rights Do I Have as an Insurance Policyholder in Louisiana?

As an insurance policyholder in Louisiana, you have specific rights to fair treatment and clear communication from your insurance company under the Louisiana policyholder bill of rights.

This includes the right to receive timely responses and clear information on your deductibles and coverage limits. You also have the right to fair claim processing and to receive explanations for any denials. Louisiana law also protects you from unfair or deceptive practices.

This means insurers cannot unreasonably delay or deny valid claims.

If an insurer fails to uphold your rights under the law, you can seek legal help to resolve your claim and hold the insurer accountable for their actions. Contact ICHQ today for a free, no-obligation consultation to learn more about options.

How Much Time Does My Insurance Company Have to Respond After a Hurricane?

In Louisiana, insurance companies have set timelines for responding to hurricane damage claims.

Within 14 days of receiving your claim, they must start an investigation and should reach a decision promptly once that investigation finishes. If they approve the claim, they have 30 days to make a payment. Louisiana law sets these time frames to prevent insurers from delaying the claims process and leaving policyholders without the funds they need.

If an insurance company misses these deadlines or delays your claim for no valid reason, they can face penalties under Louisiana law. You can also follow up with the Louisiana Department of Insurance or work with an ICHQ lawyer if you experience unreasonable delays.

How Long Do I Have to File a Hurricane Damage Claim in Louisiana?

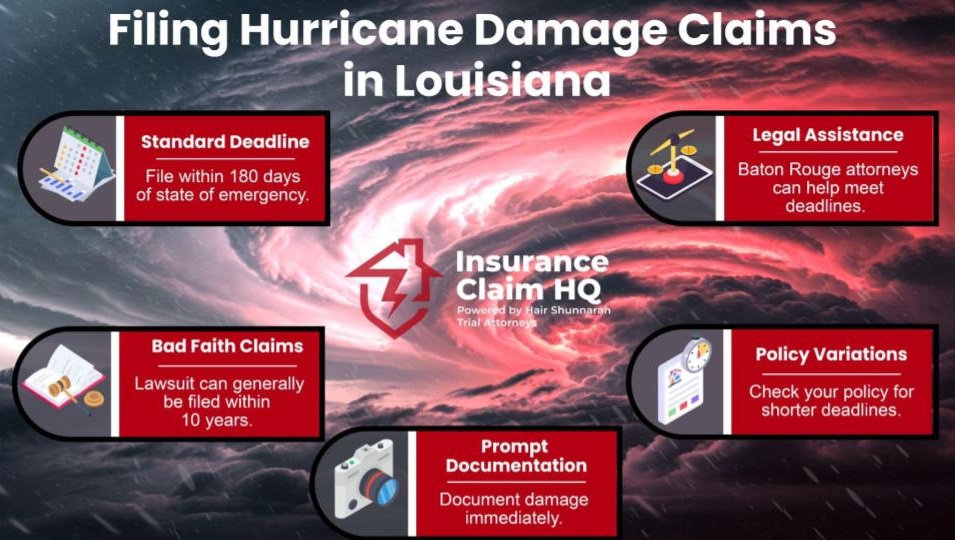

In Louisiana, you generally have 180 days from the last day of the officially declared state of emergency in which to file your hurricane damage claim.

If you miss this deadline, you may lose your right to seek compensation. It’s crucial to document the damage as soon as possible and begin the claims process promptly. A Louisiana hurricane damage attorney from ICHQ can help you stay within this timeframe and protect your rights.

Although insurance companies often require you to file claims quickly, Louisiana law provides more time for certain actions.

For example, if your insurance company unfairly denies, minimizes, or delays your claim, Louisiana law gives you up to 10 years to file a bad faith insurance claim against them. This filing window allows you ample time to take action and file a hurricane claim lawsuit if your insurer does not fulfill its obligations.

A hurricane damage lawyer in Louisiana can help you understand these timelines, protect your rights, and keep your options open if issues arise.

What Are Best Practices for Filing a Hurricane Insurance Claim?

To file an effective hurricane insurance claim, start by documenting all property damage as soon as possible.

Take clear photos or videos of each damaged area inside and outside of your home. Keep records of all repair estimates and receipts for any temporary fixes or living expenses if you need to stay elsewhere.

Notify your insurer of the claim promptly and gather as much supporting information as possible to create a strong case. Always keep copies of all communication with your insurance company and follow up regularly to keep things moving forward.

Staying organized and proactive can improve your chances of a successful and timely claim resolution.

What Does Proof of Loss Mean?

A proof of loss is a formal document that details the losses you experienced and the amount you’re claiming. This document is essential in hurricane damage claims, as it provides the insurance company with specific information about your covered losses.

A proof of loss form typically includes a detailed list of damaged property, estimates for repairs, and supporting documents like receipts for repairs or temporary housing. Submitting a complete proof of loss is a key step in the claims process, as it formally presents your case to the insurer.

Some policies have deadlines for submitting proof of loss documents, so it’s a good idea to review your policy and act promptly after a hurricane damages your property.